Florida’s Housing Market Shift: What New Jersey Real Estate Professionals Can Learn

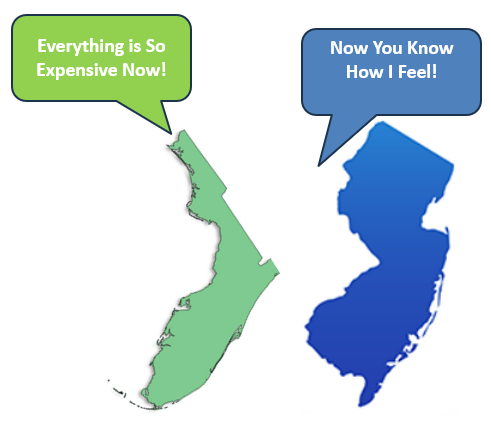

In today’s interconnected real estate landscape, market trends in one region often provide valuable insights for professionals across the country. The recent developments in Florida’s housing market offer important lessons for New Jersey real estate stakeholders, including buyers, sellers, agents, and title insurance professionals.

Market Reversal: Florida’s Growing Inventory

South Florida’s once white-hot housing market is experiencing a significant shift as inventory levels reach their highest point in nearly a decade. Available home listings have quadrupled since 2022, signaling what analysts describe as a market correction after years of explosive growth.

This dramatic increase in inventory stems from several factors:

Declining demand as pandemic-era migration patterns normalize

Local residents being priced out of their communities

Homeowners choosing to sell in response to rising costs

The Cost Burden: Insurance and Maintenance

One of the primary drivers behind Florida’s changing market is the growing financial burden on homeowners. Insurance rates have skyrocketed across the state, with many property owners facing premium increases that make continued ownership financially challenging.

Additionally, Florida’s condominium market faces unique pressures following the implementation of new building safety legislation enacted after the tragic Champlain Tower South collapse in 2021. These regulations require condominium associations to conduct regular inspections and maintain adequate reserves for repairs—creating additional financial obligations for owners.

Affordability Crisis

Despite strong median household incomes ranging between $70,000 and $80,000 in South Florida’s tricounty area, the region faces a serious affordability crisis. The gap between local incomes and housing costs has widened substantially, pushing many residents to consider relocating.

Some market observers suggest Florida has become “a victim of its own success,” with the initial appeal that drew thousands of new residents during the pandemic now diminished by the reality of higher living costs.

Implications for New Jersey Real Estate

As a New Jersey title insurance agency, understanding these national trends provides valuable context for serving our local clients. While our market dynamics differ in many ways from Florida’s, several key lessons emerge:

Market Cycles Are Inevitable: Even the hottest markets eventually cool, highlighting the importance of sustainable growth rather than rapid price escalation.

Insurance Costs Matter: While New Jersey doesn’t face the same hurricane risks as Florida, insurance considerations remain critical to overall affordability and should be carefully evaluated during transactions.

Building Reserve Requirements: New Jersey condominium associations should proactively address maintenance reserves to avoid sudden financial burdens on owners.

The Affordability Equation: Sustainable markets depend on maintaining reasonable relationships between local incomes and housing costs.

Protecting Your New Jersey Real Estate Investment

In any market—whether expanding or contracting—comprehensive title insurance protection remains essential for safeguarding real estate investments. Our New Jersey-based agency specializes in providing the expertise and coverage needed to navigate market shifts with confidence.

As Florida potentially enters a multi-year correction period with price adjustments, New Jersey property owners and investors should work closely with experienced local professionals to understand how broader market trends might influence their real estate decisions.

By staying informed about national patterns while focusing on local market conditions, New Jersey real estate stakeholders can make strategic decisions that preserve value even as markets evolve.