Other Solutions: Senior Freeze Programs

Another important program is the Senior Freeze (Property Tax Reimbursement), which reimburses eligible senior citizens and disabled persons for property tax increases on their principal residence. To qualify, homeowners must meet certain income and residency requirements. Real estate professionals should be familiar with these programs to advise clients on potential savings.

Homestead Benefit

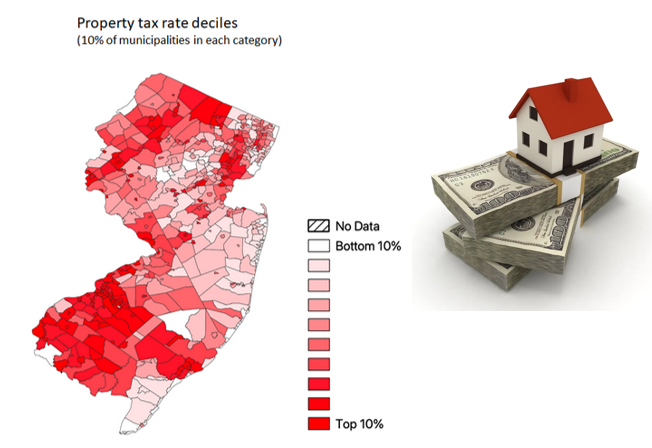

New Jersey offers several programs to help mitigate the burden of high property taxes, particularly for seniors, disabled individuals, and low- to moderate-income homeowners. The Homestead Benefit program provides property tax relief to eligible homeowners by applying a credit directly to their property tax bill.

Reducing Costs with Tax Deductions

New Jersey homeowners can also manage their property tax costs by taking advantage of tax deductions. The state allows homeowners to deduct up to $15,000 in property taxes on their New Jersey state income tax return. This deduction can provide significant savings, especially for those in higher tax brackets.

Staying Informed

Finally, it’s crucial for homeowners to stay informed about changes in property tax laws and assessments in their area. Agents should be proactive by encouraging clients to attend local government meetings where tax rates and budgets are discussed, which can help them anticipate changes and plan accordingly.

If you have any questions about this information or title insurance, please contact Ralph Aponte: 732.914.1400.

Counsellors Title Agency, www.counsellorstitle.net, founded in 1996, is one of New Jersey’s most respected title agencies, serving all 21 New Jersey counties with title insurance, clearing title, escrow, tidelands searches, and closing and settlement services for commercial or industrial properties, waterfront properties and marinas, condominiums, townhouses or residential single-family homes. Counsellors Title also features its own Attorney Settlement Assistance Program™ [ASAP], which is an individual resource customized to fit the needs specifically of real estate attorneys, including, Documentation, Preparation, Disbursement of Funds, Attendance at Closing, HUD Preparation or Post-Closing Matters.

Connect with Ralph on LinkedIn:Â https://www.linkedin.com/in/ralphaponte/