New Jersey is ranked as having the highest property taxes in the country. That said, not all counties’ and towns’ taxes are the same. Understanding how the system works and identifying the cities and townships with the lower tax rates can help agents guide their clients to discover more affordable options. Here’s a rundown of New Jersey’s property tax system and how real estate professionals can help homeowners manage their tax burdens effectively.

New Jersey’s Property Tax System: What Homeowners Need to Know

New Jersey’s property tax system is one of the highest in the nation, making it a factor in the homebuyer’s decision and affordability. Understanding how these taxes work and how to manage costs is part of the overall homebuyer’s budgeting process. Here’s what you need to know about navigating New Jersey’s property tax landscape and how you can help your clients make informed decisions that have long-term ramifications.

The Basics

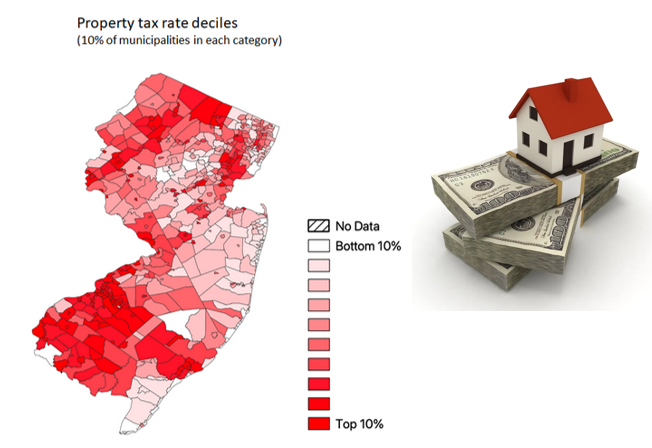

New Jersey’s property taxes are calculated based on the assessed value of a property and the tax rate of the municipality in which it is located. Each municipality determines its tax rate, which can vary significantly across the state. The tax rate is expressed in “dollars per $100 of assessed value,” so a higher rate or a higher assessed value means higher taxes.

The property’s assessed value is intended to represent the market value, but it is not uncommon for properties to be assessed at a value that is either too high or too low, depending on market fluctuations. This can lead to homeowners paying more than their fair share of taxes.

Right to Appeal an Assessment

One of the most effective ways to manage property tax costs is by appealing the assessment. Should a property be assessed at a value higher than its market value, homeowners have the right to file an appeal with their local tax assessor. This is where real estate professionals can assist their clients in gathering comparable sales data and presenting a case to the assessor. This process can result in a reduction of the assessed value, leading to lower property taxes.

The appeal process usually has strict deadlines, often in the spring, so it’s important for homeowners to act quickly if they believe their assessment is unfair. Additionally, working with a real estate attorney who specializes in property tax appeals can greatly increase the chances of a successful outcome.

If you have any questions about this information or title insurance, please contact Ralph Aponte: 732.914.1400.

Counsellors Title Agency, www.counsellorstitle.net, founded in 1996, is one of New Jersey’s most respected title agencies, serving all 21 New Jersey counties with title insurance, clearing title, escrow, tidelands searches, and closing and settlement services for commercial or industrial properties, waterfront properties and marinas, condominiums, townhouses or residential single-family homes. Counsellors Title also features its own Attorney Settlement Assistance Program™ [ASAP], which is an individual resource customized to fit the needs specifically of real estate attorneys, including, Documentation, Preparation, Disbursement of Funds, Attendance at Closing, HUD Preparation or Post-Closing Matters.

Connect with Ralph on LinkedIn:Â https://www.linkedin.com/in/ralphaponte/