If there’s one metaphor that can possibly be applied to this housing market, it’s one big obstacle course. Now with the prices of homes at all-time highs, and inventories at many times all-time lows, interest rates are now climbing into the 7% range, and with the current increase of the Fed of 75 basis points, things don’t look to be improving.

According to a number of real estate platforms, one of which being Zillow, they are estimating that the typical household will be spending 30% of their income for housing, whether it be rent or mortgage. This represents nearly a 33% increase over those same metrics as they were reported back in 2005, when the average homeowner was spending less than 23% of their income on housing.

Due to the shortage of inventory and the surge in home buying over the last two-and-a-half years, Zillow estimates that the median home value would have to fall by nearly $90,000 from the median price of $358,000 in order to become what is considered to be affordable. But as inflation continues to dig its teeth into people’s pocketbooks, home prices may not be the first victims on the inflation target list.

The unaffordability aspect in this market is not equally distributed, where cities such as Baltimore, Chicago and Philadelphia appear to be much more affordable, and they may prove to be the markets that see an increased interest from homebuyers, resulting in the gentrification of these markets.

This affordability crisis is expected to last years, not months.

The continued high mortgage rates is forcing the monthly mortgage payment to rise 55% higher than it was less than a year ago. With higher interest rates, there are fewer buyers moving into the market, but still demand for housing is strong, thus the increase in rental costs. Some first-time buyers are actually looking at smaller properties in order to adjust their budgets for the higher costs involved. According to the National Association of Realtors, for the last 3 months home prices have declined, and there have been more homes on the market cutting their list prices which translates into 20% of homes recently have reduced their prices. But demand continues to drive the median sales price higher by 8.4% over the course of the last year.

Still, affordability, now compounded by inventory shortages and high interest rates, are probably going to cause this market to flatline in terms of price and number of transactions for the foreseeable future, thus causing people to remain in their houses for longer periods of time.

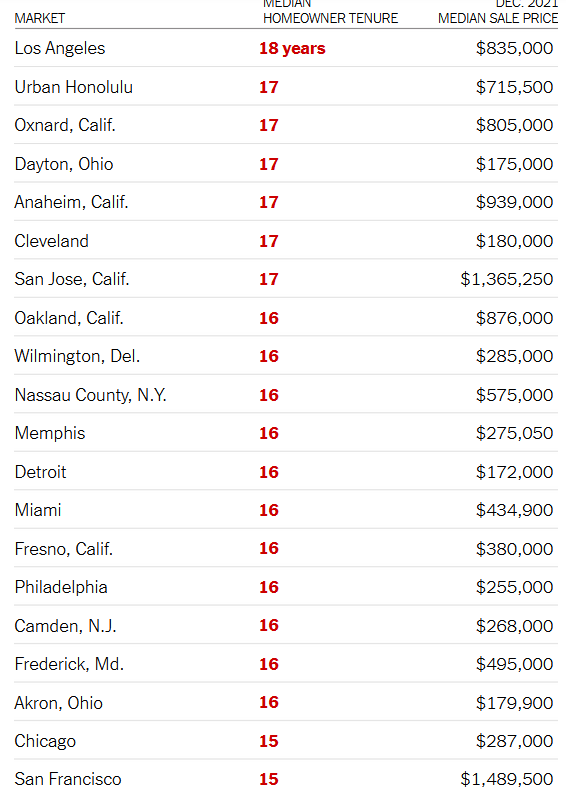

Below the chart is showing the cities in which people remain in their homes longest on average, with Los Angeles coming in at number one, where the average homeowner remains in their house for 18 years, and San Francisco rounding out the top 20, where the average homeowner remains in their house for 15 years.

If you have any questions about this information or title insurance, please contact Ralph Aponte: 732.914.1400.

Counsellors Title Agency, www.counsellorstitle.net, founded in 1996, is one of New Jersey’s most respected title agencies, serving all 21 New Jersey counties with title insurance, clearing title, escrow, tidelands searches, and closing and settlement services for commercial or industrial properties, waterfront properties and marinas, condominiums, townhouses or residential single-family homes. Counsellors Title also features its own Attorney Settlement Assistance Program™ [ASAP], which is an individual resource customized to fit the needs specifically of real estate attorneys, including, Documentation, Preparation, Disbursement of Funds, Attendance at Closing, HUD Preparation or Post-Closing Matters.

Connect with Ralph on LinkedIn: https://www.linkedin.com/in/ralphaponte/