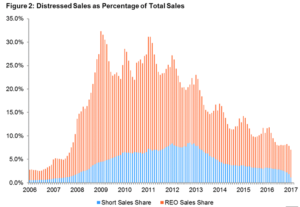

CoreLogic reported that distressed sales for the month of January hit a 10-year low.

According to the CoreLogic report, REOs made up 5.9% of distressed sales, while short sales made up 1.1% in January 2017.

Cash sales held steady in January, but distressed sales dropped year-over-year, according to a new report from CoreLogic.

The report noted that distressed sales share fell to just 7% in January, which is down 4.6% from January 2016, marking the lowest distressed sales share for any month since September 2007.

Prior to the real estate meltdown of 2008, the share of distressed sales ran around 2%. The CoreLogic report projects that this level could potentially be reached by 2018 at the current rate.

Fast Facts:

January 2017 States With Largest Percentage of Distressed Sales

1. Connecticut 17.3%

2. Maryland 16.3%

3. Michigan 15.1%

4. New Jersey 15.1%

5. Illinois 12.8%

The breakdown of distressed sales for January 2017 translated into:

REO cash sales at 61.2%

Resales at 36.5%

Newly constructed homes at 17.7%